Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

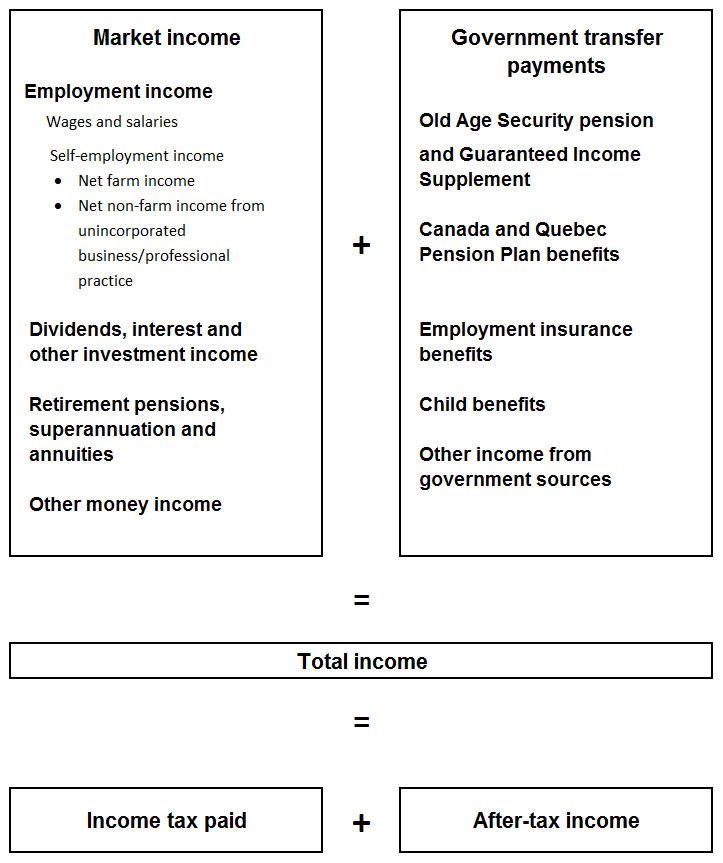

Figure 3.1 Components of income in 2010

Description

Figure 3.1 depicts Total income as having two main components: (1) Market income and (2) Government transfer payments.

Market income is shown to be the summation of (1) Employment income, which is wages and salaries plus self-employment income, (2) Dividends, interest and other investment income, (3) Retirement pensions, superannuation and annuities and (4) Other money income.

Government transfer payments are shown to comprise (1) Old Age Security pension and Guaranteed Income Supplement, (2) Canada Pension Plan and Quebec Pension Plan benefits, (3) Employment Insurance benefits, (4) child benefits and (5) Other income from government sources.

Furthermore, Figure 3.1 also depicts Total income as the summation of income tax paid and after-tax income.

Source: Statistics Canada, Income Statistics Division.

- Date modified: